Strengthening the Equity Derivatives Framework: SEBI’s New Measures Effective November 20, 2024

On October 1, 2024, the Securities and Exchange Board of India (SEBI) issued a landmark circular introducing key measures to enhance the equity derivatives framework. These reforms aim to protect investors, promote market stability, and address the rising retail participation and speculative trading in this segment.

The circular outlines six major measures that will be phased in between November 20, 2024, and April 1, 2025. This blog focuses on the three measures set to take effect starting November 20, 2024.

1. Rationalization of Weekly Index Derivatives

Effective Date: November 20, 2024

To streamline weekly index derivatives, SEBI has limited these contracts to a single benchmark index per exchange.

- NSE will offer weekly derivatives only on Nifty 50.

- BSE will focus on Sensex for its weekly derivatives.

This measure simplifies the trading landscape, reduces the clutter of multiple options, and helps traders focus on the most liquid benchmarks.

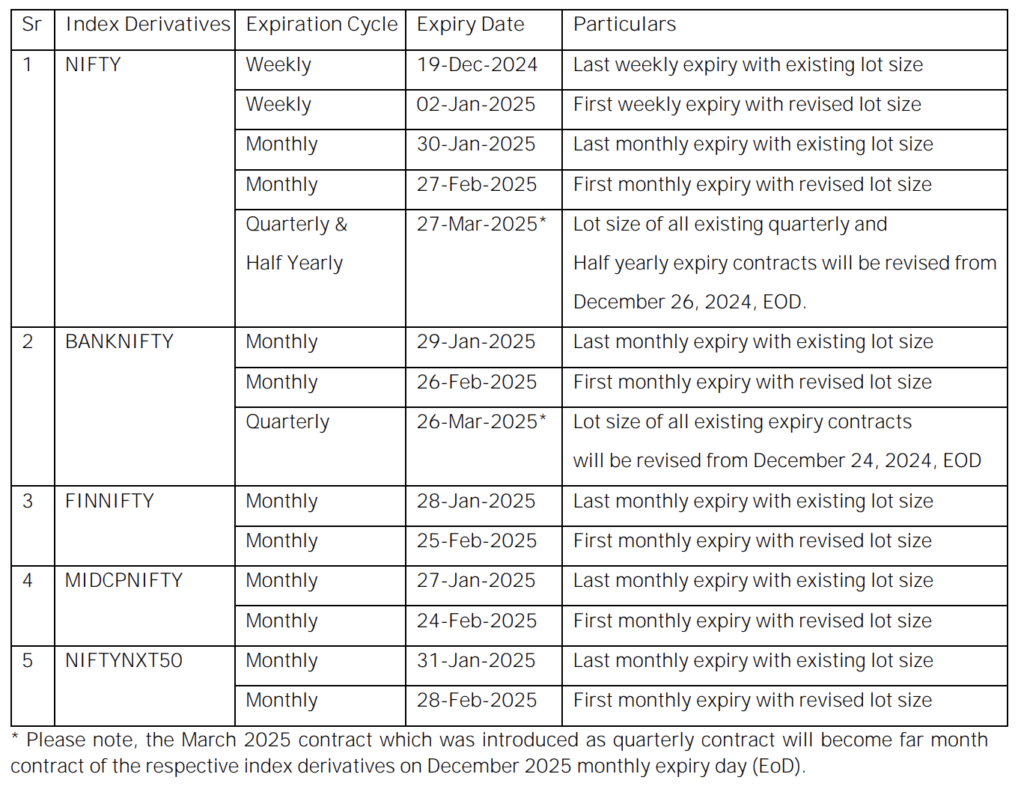

2. Revision of Index Derivatives Lot Sizes

Effective Date: November 20, 2024

SEBI has raised the minimum contract value for index derivatives to ₹15–20 lakhs. In response, exchanges like NSE and BSE have revised their lot sizes for index derivatives.

While existing contracts will retain their lot sizes, new contracts introduced after November 20, 2024, will reflect the updated lot sizes:

| Underlying Index | Existing Market Lot | Revised Market Lot |

|---|---|---|

| Nifty 50 | 25 | 75 |

| Nifty Bank | 15 | 30 |

| Nifty Financial Services | 25 | 65 |

| Nifty Midcap Select | 50 | 120 |

| Nifty Next 50 | 10 | 25 |

| Sensex | 10 | 20 |

| Bankex | 15 | 30 |

| Sensex 50 | 25 | 60 |

This move not only ensures higher contract value alignment but also discourages excessive speculative trading by retail participants.

3. Increased ELM for Short Options on Expiry Day

Effective Date: November 20, 2024

To mitigate risks arising from heightened volatility on expiry days, SEBI has introduced an additional Extreme Loss Margin (ELM) of 2% on all short options positions expiring on the same day.

What is ELM?

ELM is an additional margin charged by exchanges to safeguard against unforeseen risks. This buffer aims to shield traders and the market from sharp, unexpected price movements.

Why is it Necessary?

Expiry days often see a surge in speculative trading, with traders taking high-risk positions to leverage short-term price movements. Such activity can lead to extreme price fluctuations, particularly affecting traders with short positions.

By levying an extra 2% ELM:

- Markets gain an added layer of protection against potential losses.

- Risky speculative behavior is curbed, enhancing overall market stability.

This measure applies to both:

- Short positions held at the start of the trading day.

- New short positions initiated on expiry day.